Health Grants for a Financial Institution

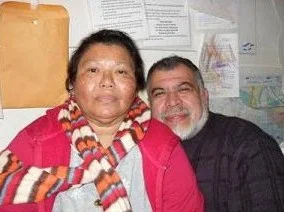

/MIRIAM AND JOSE WENT TO INNOVATIVE CHANGES TO BUILD THEIR CREDIT.

The answer makes sense once you know more about the nonprofit financial institution, Innovative Changes, and the grant maker, which in this case is the Kaiser Permanente Community Fund.

Kaiser Permanente Community Fund (KPCF) is a partnership between Kaiser Permanente Northwest and Northwest Health Foundation. The fund invests grantmaking dollars in the places “where health begins” —projects and organizations whose work addresses the social determinants of health.

As the staff at Innovative Changes can tell you, financial issues can very often be connected directly to health. Research shows a strong correlation between high income and good health. Likewise, financial struggles often lead to a downward spiral culminating in emergency rooms, shelters, hospitals, or even the streets.

People in financial crisis often turn to payday loans, which almost always exacerbate the situation. A $300 car repair can mean that a single mom with a stable job cannot get her children to daycare or herself to work. This can result in lost wages, and an increase in family stress. If monthly bills aren’t paid, a payday loan can push her into an unsustainable cycle of debt. Her credit and rental history are damaged, and her struggles only get worse.

“We know that financial stress can have serious health effects on an individual and also on family members,” says Victor Merced, a member of the Kaiser Permanente Community Fund advisory board.

Innovative Changes offers an alternative to predatory payday loans by providing comprehensive financial education, small dollar, short-term consumer loans, and credit building opportunities to help people manage short-term financial needs in order to achieve and maintain financial and household stability.

“This initiative helps ensure that there is an affordable and socially responsible alternative to the provision of predatory financial products and services,” said Mary Edmeades, Vice President and Manager at Albina Community Bank. “The integrated approach to partnerships with the mainstream financial industry, other social service providers and most importantly, the clients themselves, is a collaborative model that promotes innovation, accountability and sustainability.”

Miriam and José (pictured) came to the U.S. 32 years ago as they fled the civil war in their native El Salvador, and are two appreciative clients of Innovative Changes. Their story demonstrates the strong network of community partnerships developed by the nonprofit. In this case, Innovative Changes worked with two of their partners, Proud Ground, and the Native American Youth and Family Center (NAYA).

“We’re glad we came here and got help,” José said.

Jose works as a pastor associate and deacon at a Catholic church and works extensively with the church’s Hispanic community.

“One of my goals is to be a better administrator of my money, in order to help the community manage their money better as well.”

When asked to comment about the support they received from the nonprofit, Jose explained that “they made us feel secure.”

Miriam added, “This is real.”

“Innovative Changes helped us build our credit,” José said.

“They gave us hope for the future.”